Last Day For Ira Contribution 2025

Last Day For Ira Contribution 2025 - Last Day Roth Ira 2025 Roxie Clarette, $7,500 if you're aged 50 or older. Simple Ira Limits 2025 And 2025 Carol Cristen, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Last Day Roth Ira 2025 Roxie Clarette, $7,500 if you're aged 50 or older.

Deadline For Making Ira Contribution For 2025 Sonni Alejandrina, The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

2025 Ira Contribution Limits Irs Marji Shannah, In 2025, that means you can contribute toward your 2025 tax year limit of $6,500 until april 15.

2025 Max Roth Ira Contribution Elset Katharina, You can only contribute earned income to an ira, including salaries and net earnings from your business.

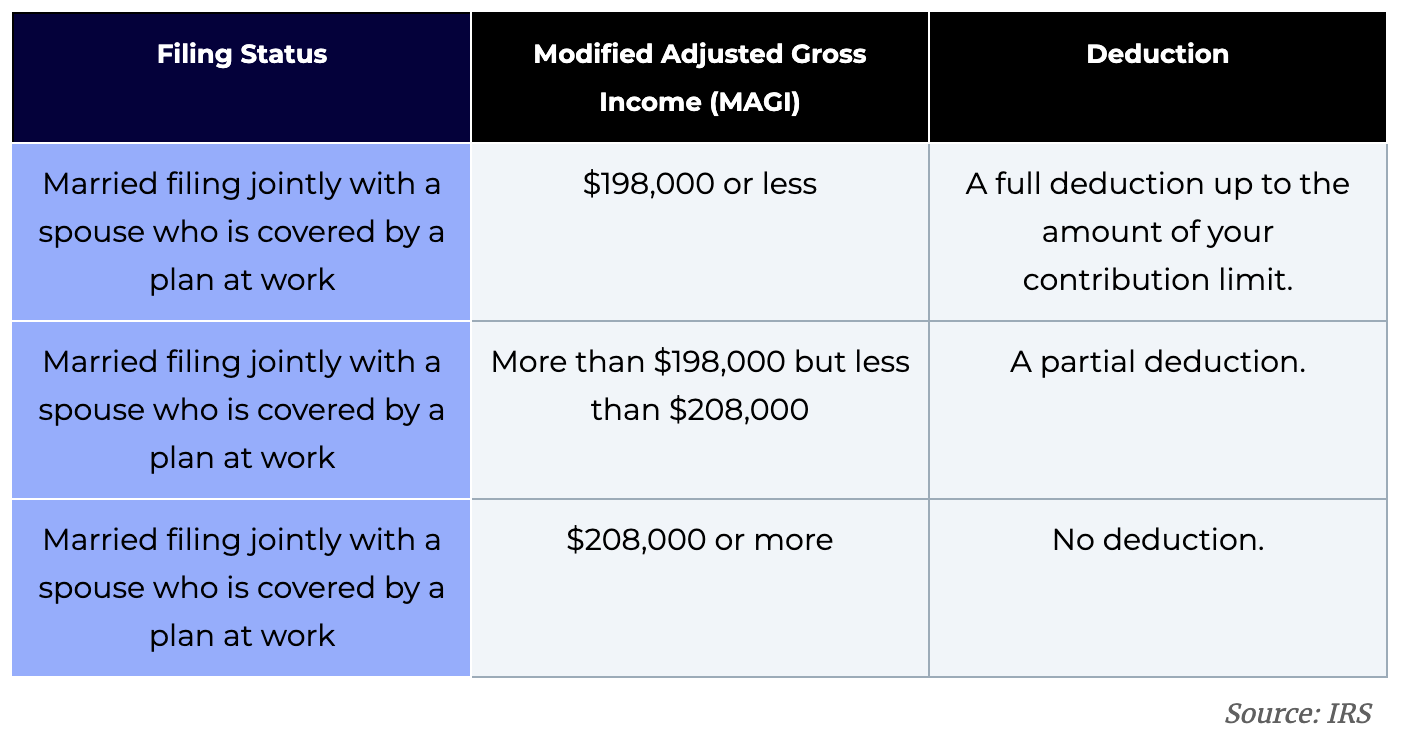

401k Max Contribution 2025 And Ira Contribution Limits Eleni Hedwiga, Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on.

Deadline To Fund Ira For 2025 Alfy Belinda, As a general rule, you have until tax day to make ira contributions for the prior year.

Maximum Ira Catch Up Contribution 2025 Over 50 Dian Genvieve, In 2025, that means you can contribute toward your 2025 tax year limit of $6,500 until april 15.

Last Day For Ira Contribution 2025. As a couple, you can contribute a combined total of $14,000 (if you're both under 50) or $16,000 (if you're both 50 or older) to a traditional ira for 2025. Ira contribution limit increased for 2025.

Ira Contribution Limits 2025 Roth Gretta Cecilla, If you’re still working, review the 2025 ira contribution and deduction limits to make sure you are taking full advantage of the opportunity to save for your retirement.

1, 2025, you can also make contributions toward your 2025. The most you may contribute to your roth and traditional iras for the 2025 tax year is:

Irs Simple Ira Contribution Limits 2025 Annis Brianne, Less than $230,000 if you are married filing jointly or a qualifying.